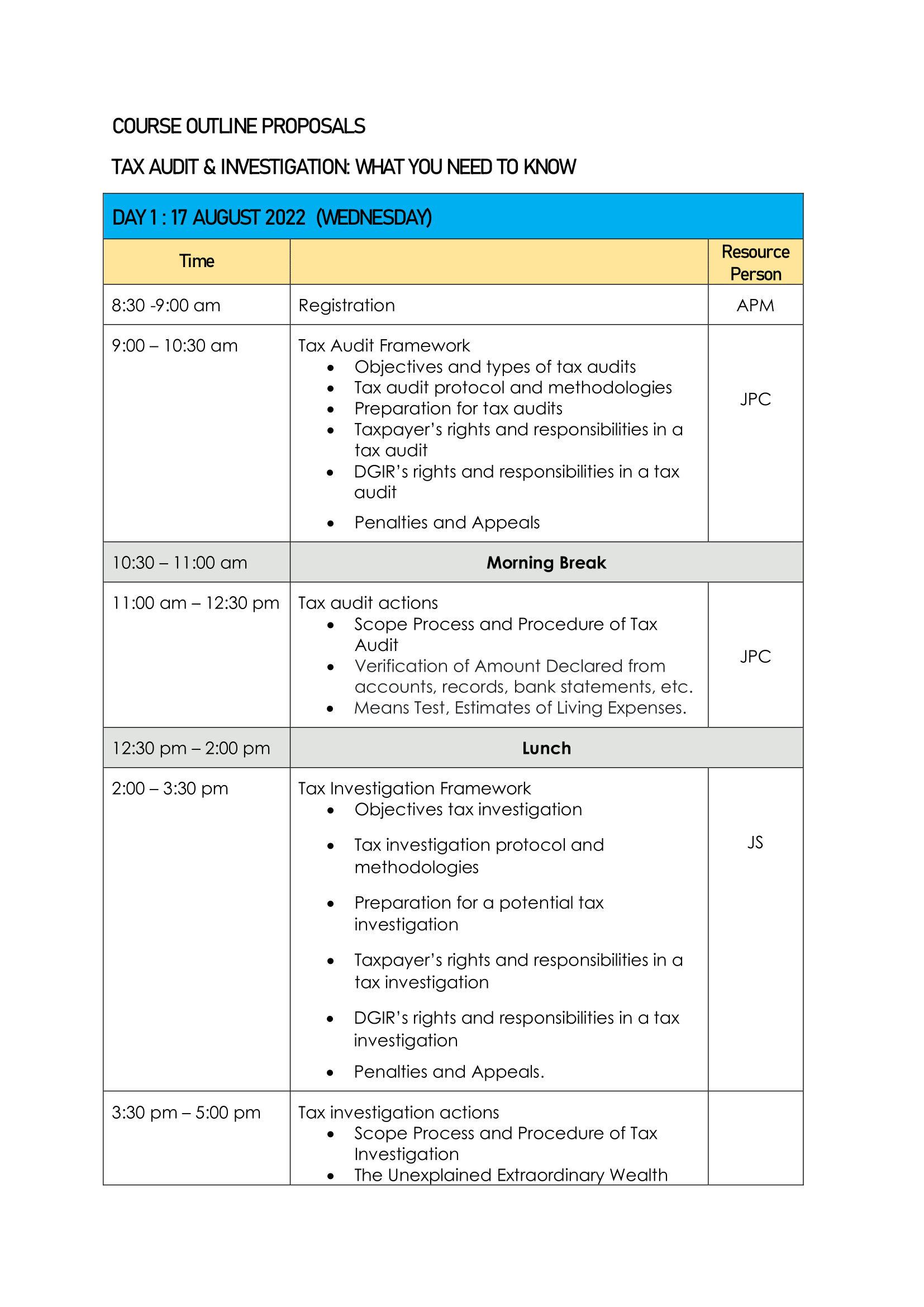

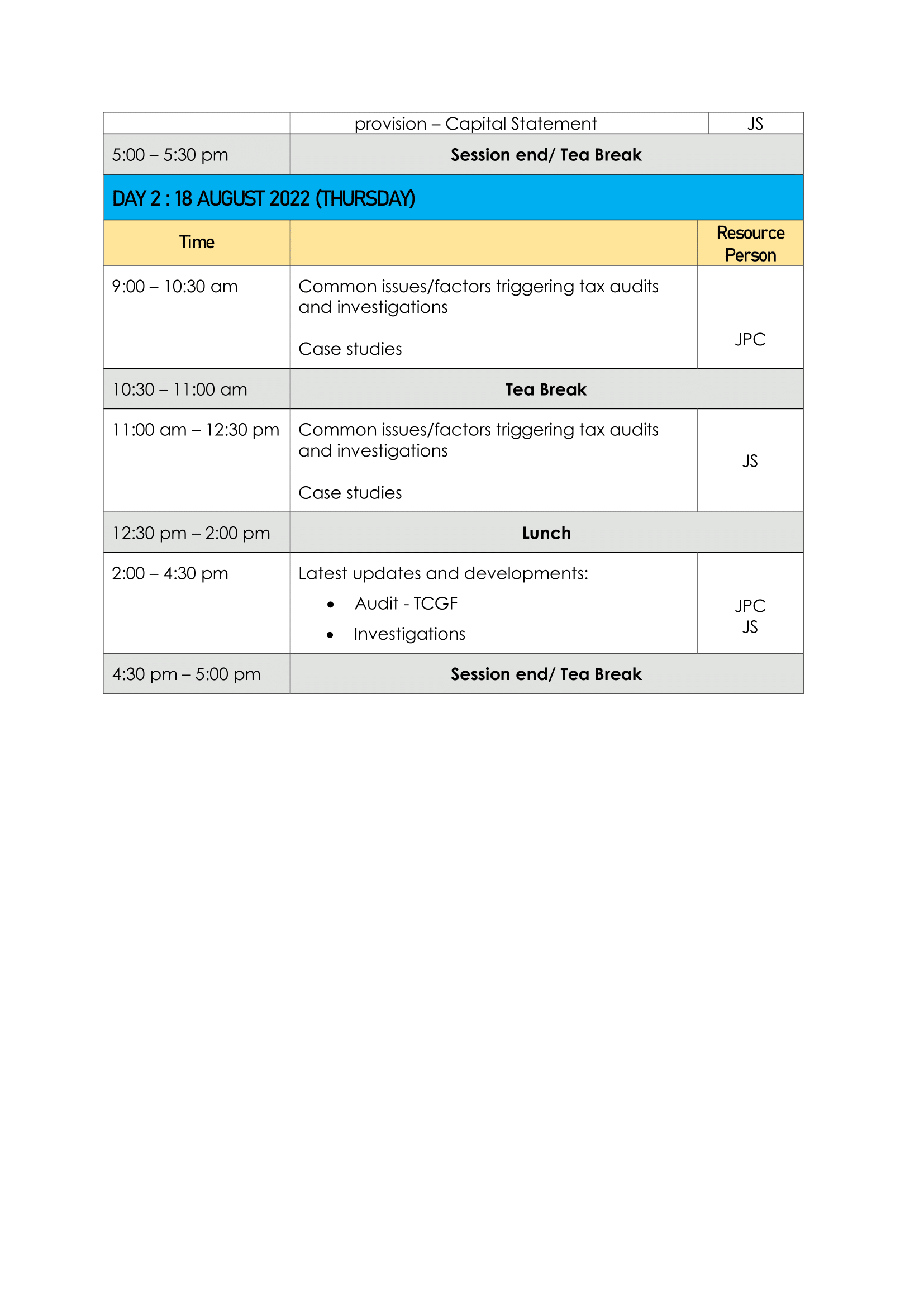

EXCLUSIVE FOR MATA MEMBER ONLY

Resource Person: APM

• Objectives and types of tax audits • Tax audit protocol and methodologies • Preparation for tax audits • Taxpayer’s rights and responsibilities in a tax audit • DGIR’s rights and responsibilities in a tax audit • Penalties and Appeals Resource Person: JPC

• Scope Process and Procedure of Tax Audit • Verification of Amount Declared from accounts, records, bank statements, etc. • Means Test, Estimates of Living Expenses. Resource Person: JPC

• Objectives tax investigation • Tax investigation protocol and methodologies • Preparation for a potential tax investigation • Taxpayer’s rights and responsibilities in a tax investigation • DGIR’s rights and responsibilities in a tax investigation • Penalties and Appeals. Resource Person: JS

• Scope Process and Procedure of Tax Investigation • The Unexplained Extraordinary Wealth provision – Capital Statement Resource Person: JS

Case studies Resource Person: JPC

Case studies Resource Person: JS

• Audit - TCGF • Investigations